How Christian Organizations Continue to Manage Portfolios By Rich Todd and Sarah Newman

Back to Blog

Six Reasons Why Christian Organizations Still Take a Secular Approach

Investment committees responsible for managing the assets of Christian organizations frequently overlook or only partially utilize Christian investment principles. This article explores the reasons behind this approach and explains why it may ultimately be a mistake.

Principles for Building a Christian-Aligned Portfolio

- Creating a values policy that clearly outlines the issues that the organization cares about. This frequently includes eliminating investments for the portfolio in areas such as abortion, pornography, child labor, etc. An emphasis on companies that enhance “human flourishing” might also be a consideration.

- Asset managers should screen the portfolio based on the organization’s values policy. Most asset managers use an outside service to create a “do not buy” list. This approach can vary from firm to firm. We recommend that the advisor do a secondary evaluation to ensure that the screening is accurate.

- A values assessment of each asset manager should be conducted to ensure that they are not values “misaligned.” It is essential to ask questions. Know their stance on religious freedom in the workplace, corporate and donation support, employee benefits, and the markets they target. This assessment should apply to the advisor, consultant, and asset managers. Many firms manage money for Christian organizations whose values are completely misaligned, and that’s a problem!

- The organization’s investment committee should control the proxy voting process. Many corporate resolutions are blatantly anti-Christian. Most investment committees ignore the importance of proxy voting; they can end up voting in favor of these measures! Many asset managers will delegate voting to a proxy advisor. Most of the largest proxy advisors will typically vote in an anti-Christian manner. An organization’s advisor or consultant should be providing guidance on these issues, since this is an important fiduciary responsibility.

- Of course, the basic tenets of fiduciary investing continue to apply. A sound asset allocation process, a clear investment policy statement, a prudent investment due diligence and asset manager selection process, and ongoing monitoring and evaluation are all essential.

What are the primary reasons that investment committees stop short of fully implementing values-aligned Christian investing?

#1 Advisors May Lack Specific Expertise

While an advisor may be Christian, they can lack the expertise or experience to develop a fully Christian-aligned portfolio. This may be a reason to consider alternative advisors—their specialized knowledge in this area may better support a Christian organization’s goals.

#2 Advisory Firms Lack Capabilities

A recent review of a Wall Street firm’s platform showed that it lacked access to Christian products, had limited ability for separate account managers to conduct Christian portfolio screening, and could not utilize Christian proxy advisors. Many platforms are too rigid and do not allow for prudent Christian investing.

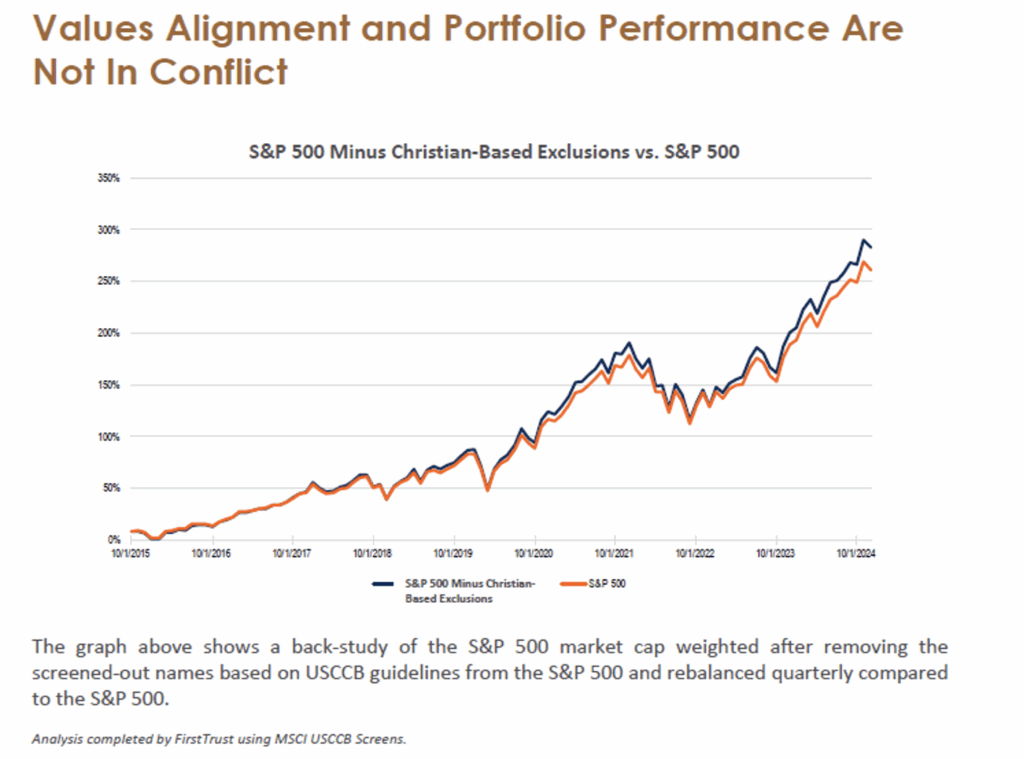

#3 Belief Christian Investing Will Cost Returns

The last 10 years have shown the opposite to be true.

In addition, many high-quality products have entered the market during this time, focusing on companies with great cultures that promote and elevate human flourishing.

#4 No Direction From the Top

Investment committees may feel uncomfortable about adopting a Christian portfolio management approach when leadership has not made it a priority. When leaders embrace Christian values and direct their committees to manage portfolios with those values in mind, it provides clarity, confidence, and alignment throughout the organization.

#5 Christian Investing Is Complicated

With the guidance of an experienced advisor or consultant, Christian-aligned investing can be made easier and less complicated. A knowledgeable advisor will be process-oriented and equipped with quality tools and expertise to create and maintain a solid Christian investment program.

#6 Investment Committee Apathy

Committees are typically composed of volunteers and can naturally gravitate to the status quo. Implementing term limits can keep apathy from occurring.

The good news is that a movement is beginning to take place. Some well-known and respected Christian organizations are taking a much more intentional approach to investing by implementing fully screened portfolios, partnering with values-aligned asset managers and advisors, engaging in quality Christian proxy voting, and participating in corporate engagement. This momentum is likely to inspire other organizations to make positive changes as well.

Richard Todd | CEO, Principal & Co-Founder, is the CEO and Co-Founder of Innovest Portfolio Solutions. He has more than 38 years of experience in investment consulting and provides investment consulting services to faith-based organizations, institutions, and families. Innovest has over 300 clients with assets of $50 billion, 61 employees, and 21 partners. https://www.innovestinc.com/richard-todd

Sarah Newman | Principal, is responsible for business development in the faith-based and secular nonprofit markets. She has over 20 years of experience in nonprofit development, marketing, event planning, and business development. Sarah has also been a small business owner for 15 years.

Fall Term 2025 Closes on Monday, September 22, 2025. Don’t miss out on these dynamic learning experiences!

Table of Contents

- Six Reasons Why Christian Organizations Still Take a Secular Approach

- Principles for Building a Christian-Aligned Portfolio

- #1 Advisors May Lack Specific Expertise

- #2 Advisory Firms Lack Capabilities

- #3 Belief Christian Investing Will Cost Returns

- #4 No Direction From the Top

- #5 Christian Investing Is Complicated

- #6 Investment Committee Apathy

CLA Membership

Join Christian

Leadership Alliance

A commitment to membership unlocks a more comprehensive access to content, community, and experiential learning. Here are the three membership exclusives that exist to significantly accelerate your professional growth and personal development.