Not-for-Profit Accounting and Reporting Issues By Brown and Jakosz

3 Key Not-for-Profit Accounting and Reporting Issues

There have been many changes in not-for-profit accounting and auditing standards recently, along with other reporting developments and considerations. Here’s a look at three of the most significant issues your organization should be aware of.

Non-financial Gifts-in-Kind

Many not-for-profit organizations rely on donations of nonfinancial gifts-in-kind (GIK) — donations that are not cash or are not going to turn into cash. This includes items such as household goods, clothing, food, and medical equipment.

Valuation and financial reporting issues around GIK continue to be controversial, with scrutiny from regulators, watchdog agencies, and donors. There also have been several recent court cases brought by state attorney generals, with significant proposed fines.

If your organization accepts GIK, consider the following:

- Contributions of GIK are reported at fair value when received. FASB Accounting Standards Codification (ASC) 820, Fair Value Measurement, explains how to measure this and defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.”

- Determining fair value can be complicated and is beyond the scope of this blog post. In general, the ideal determination is based on observable prices in an active market with the greatest transaction volume for the GIK. The reliability of the data used in the valuation process is critical. The valuation information should come from a verifiable and neutral source that conforms to the accounting standards.

- GIK use often has donor restrictions, and sometimes has legal restrictions. If this applies to any GIK at your organization, make sure you understand whether the restrictions affect your organization or the assets being donated.

- If the restrictions apply to the donated assets, they affect valuation. An example is medicine sourced abroad that cannot be resold in the U.S. because it does not meet FDA standards.If the restrictions apply to your organization, it will affect the classification of net assets, but not the determination of fair value. An example would be if a donor contributes medicine for use in specific countries.

It’s important to understand the standards, as well as the methods and data sources underlying pricing information, to ensure that GIK is properly valued at your organization. This will help you avoid scrutiny from regulators and watchdog agencies.

Grants and Contracts

FASB Accounting Standards Update (ASU) 2018-08, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made, was released in June 2018 and applies to all not-for-profit and business entities that receive or make contributions, unless otherwise indicated.

Here are a few things to note:

- Designing effective review procedures of agreements and transaction is critical.

- The intent of the ASU is to apply the same guidance for both grantors and recipients. The entities do not need to track each other’s accounting or mirror the same accounting treatment to achieve the same reporting results. For contribution (nonreciprocal) transactions, follow the guidance in FASB ASC 958-605, Clarifying the Scope and the Accounting Guidance for Contributions Received and Contributions Made.

- There will likely be more grants and contracts being accounted for as contributions. Plus, it’s less costly than accounting for these under FASB ASC 606, Revenue Recognition.

- If a resource provider is receiving direct commensurate value in return for the resources transferred, the transaction is accounted for as an exchange transaction.

Revenue Recognition

Recognizing revenue properly can be challenging for not-for-profits. The standards in FASB ASU 2014-09, Revenue from Contracts with Customers, apply to all entities, including not-for-profits, that have contracts with customers. (There are a few exceptions, including leases accounted for under FASB ASC 840 and insurance contracts accounted for under FASB ASC 944).

Public business entities, certain not-for-profit entities, and certain employee benefit plans have applied the guidance in ASU 2014-09 to annual reporting periods beginning after December 15, 2017. All other entities will apply the guidance to annual reporting periods beginning after December 15, 2018.

ASU 2014-09 includes guidance on:

- How not-for-profit organizations should account for membership dues, lifetime membership dues, subscription revenue, and lifetime subscriptions

- Bifurcation of transactions received that are in part a contribution and in part an exchange transaction (e.g., membership dues, bargain purchases, certain grants, naming opportunities, and donor status transactions)

- Tuition and housing revenue for not-for-profit higher education institutions

This post is meant to provide a high-level overview of these issues to help you begin considering and planning for them. Please contact us at info@capincrouse.com with questions or to discuss how these issues might impact your organization.

####

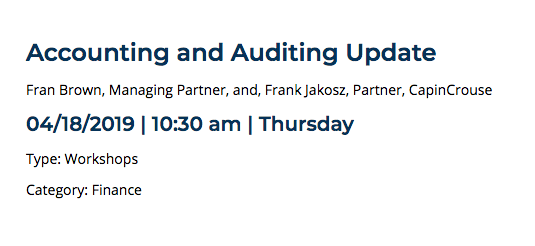

Fran Brown is Managing Partner at CapinCrouse, a national full-service CPA and consulting firm devoted to serving nonprofit organizations. Fran has more than 30 years of experience providing audit and management consulting services to a variety of nonprofit entities, including colleges and universities, churches, and large nonprofit organizations.

Frank Jakosz serves as Partner and Quality Assurance Director at CapinCrouse. Frank has more than 45 years of public accounting and nonprofit expertise and a deep understanding of nonprofit organizational best practice financial functions and operations. His expertise includes financial reporting and analysis, investments, internal controls, endowments, and grants management.

Christian Leadership Alliance will be featuring the wisdom and expertise of both Fran Brown and Frank Jakosz at the Outcomes Conference 2019.

Be sure to register TODAY and bookmark their workshop!

In this workshop, you’ll get up to speed on current accounting and auditing standards for nonprofits, including the many recent changes, and plan for how they may affect your organization. They will cover the financial statement changes, new pronouncements on contributions and exchange transactions and other key updates.

In this workshop, you’ll get up to speed on current accounting and auditing standards for nonprofits, including the many recent changes, and plan for how they may affect your organization. They will cover the financial statement changes, new pronouncements on contributions and exchange transactions and other key updates.

www.OutcomesConference.org

What is Christian Leadership Alliance?

Christian Leadership Alliance equips and unites leaders to transform the world for Christ. We are the leaders of Christ-centered organizations who are dedicated to faithful stewardship for greater kingdom impact.

Sign up for FREE blog updates.

Upcoming Events

Check back later!